SMART Doc® V1 / V3 Compliance

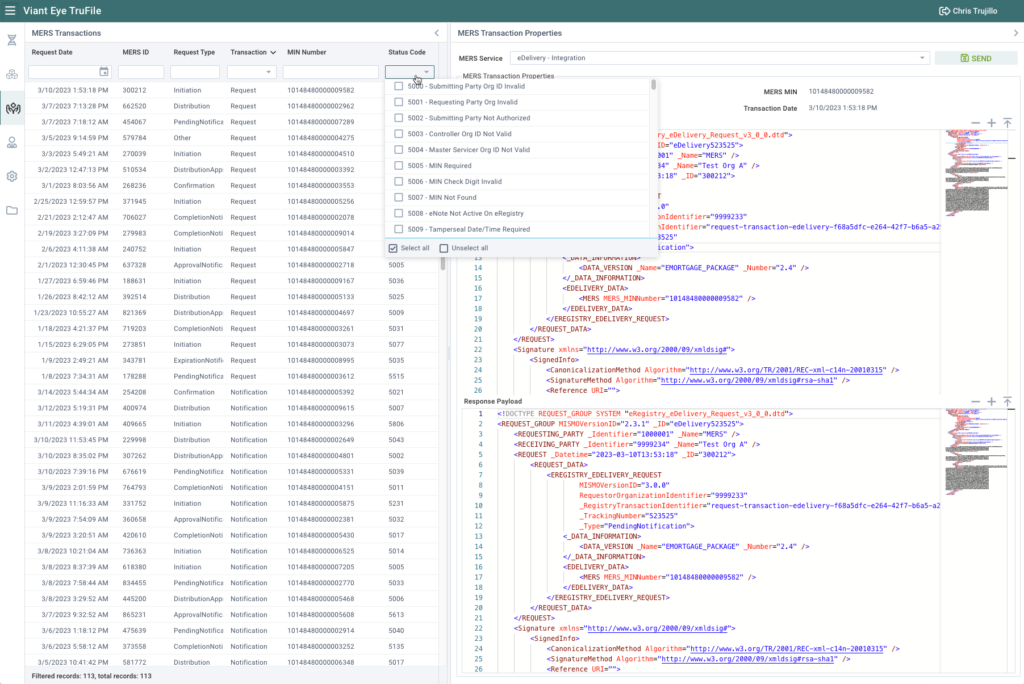

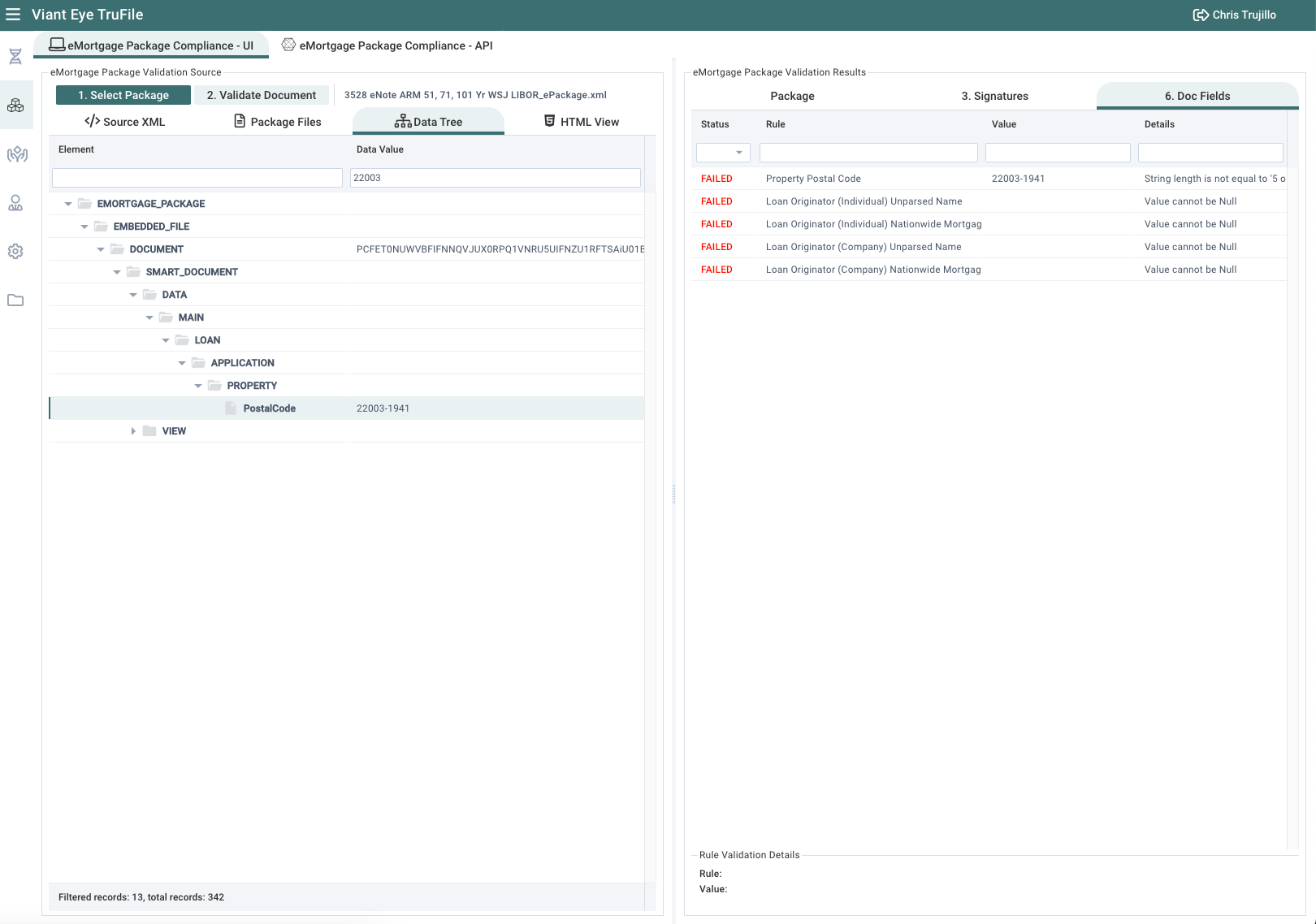

Viant Eye’s TruFile Validation platform is a comprehensive data validation solution for SMART Doc®, ensuring compliance with MISMO and investor requirements. TruFile streamlines interoperability, legal enforceability, and regulatory compliance while reducing time and cost for customers. With an easy-to-implement API and on-premises deployment option, TruFile eliminates the need for extensive expertise, freeing up internal resources and maintaining data security.

Validation of documents against the industry-standard Smart Doc specification

Comprehensive set of validation rules and error messages

Customization and extension capabilities for on-premises deployments

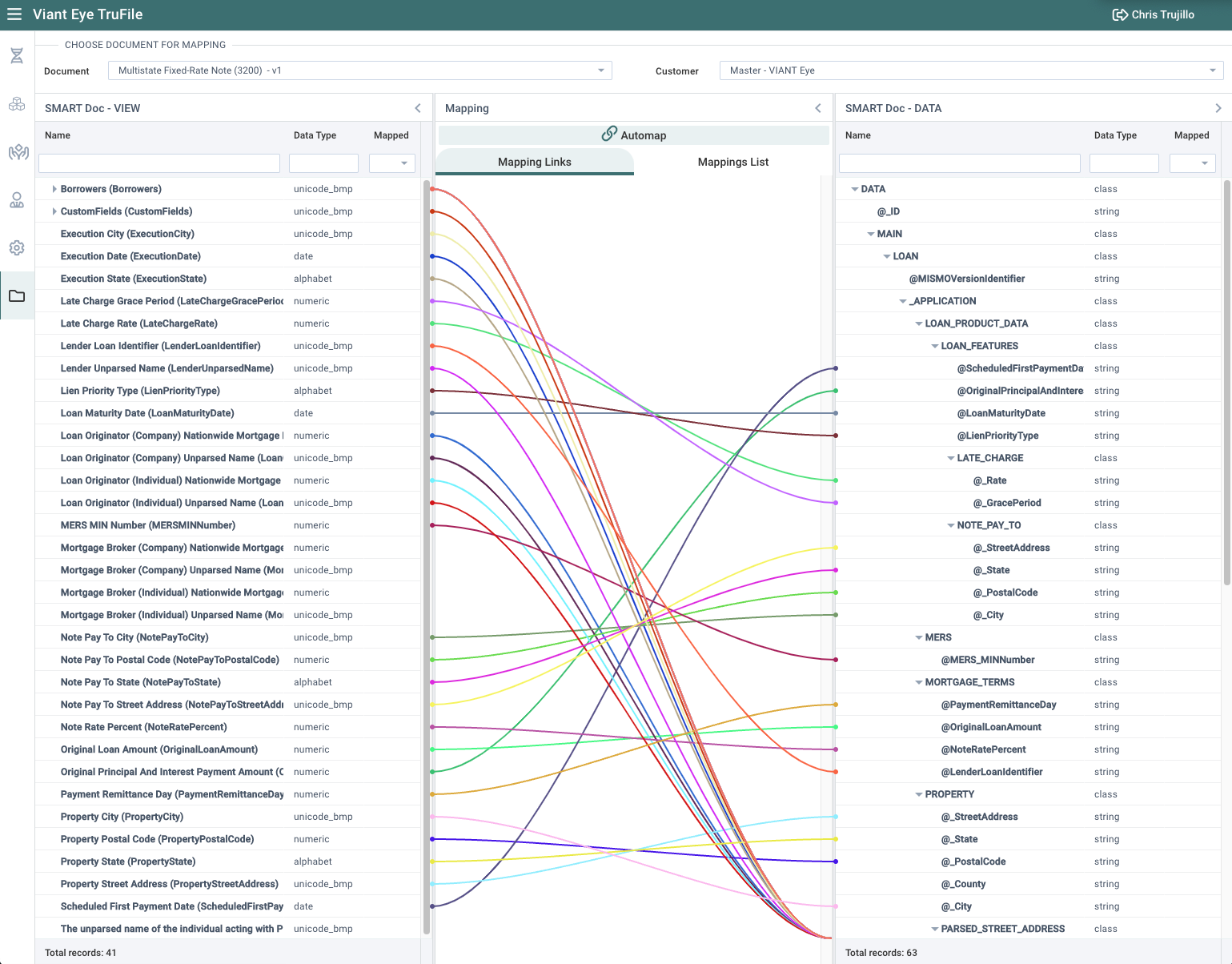

SMART Doc® V1 / V3 Generation

TruFile Generation, a cutting-edge SMART Doc® generation product, revolutionizes the mortgage experience by streamlining the creation and management of SMART Docs. With features such as easy mapping to industry and investor datasets, a rapid development UI interface, on-premises deployment, and customizable forms, TruFile ensures industry compliance and enhances efficiency.

Intuitive mapping to industry and investor datasets

Developer friendly interface enables quick and easy generation, editing, and management of mortgage documents

Secure, on-site deployment options to maintain control and safeguard sensitive mortgage data.

Easily integrate with existing mortgage and loan origination systems for a cohesive user experience

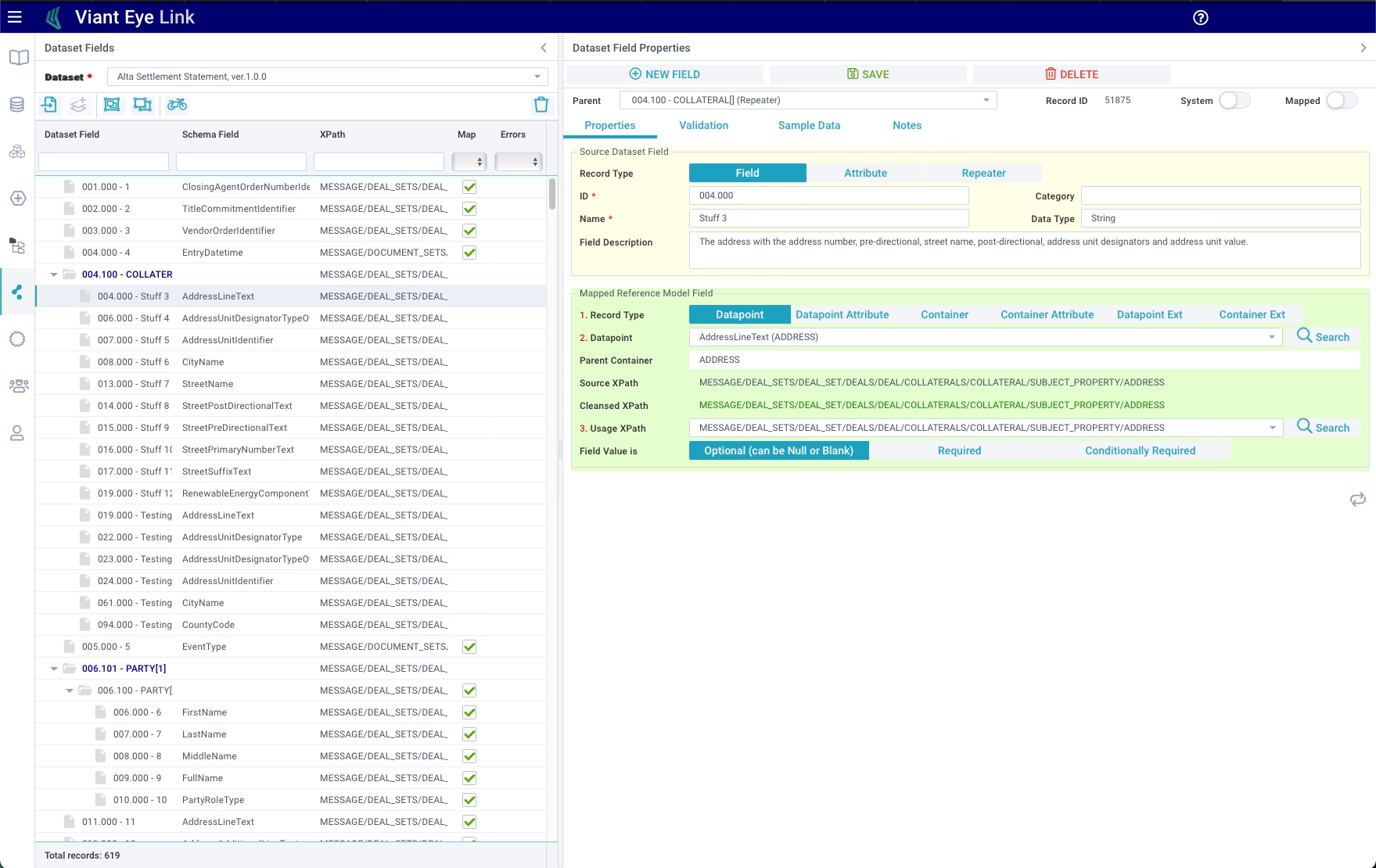

LINK

Viant Eye’s LINK platform is a tool focused on managing the mapping of systems and automating the creation of APIs.

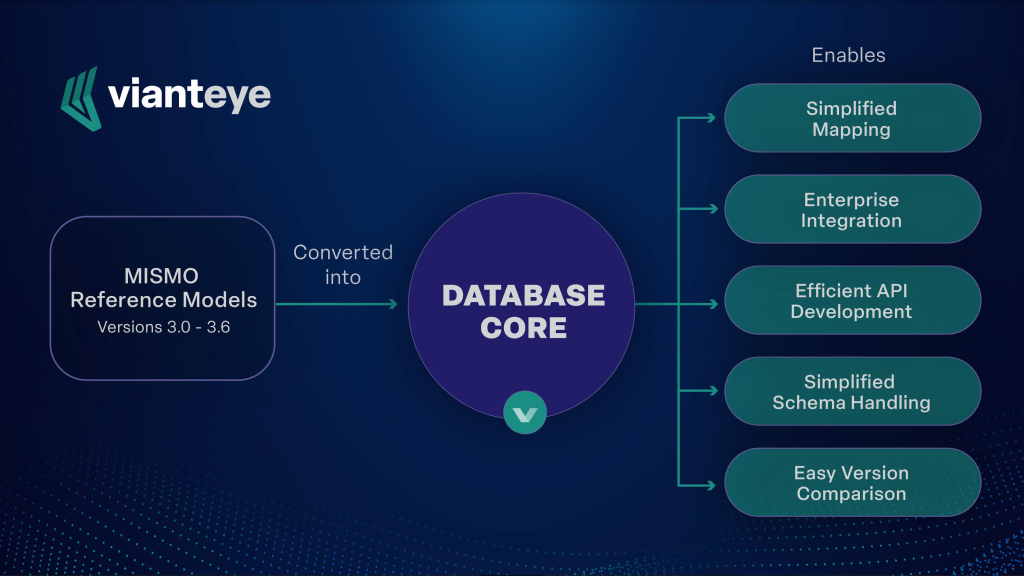

Database Core

Database Core enables companies, who have existing data governance tools, to upload the MISMO reference models into their existing tools. Database Core enables companies to use their own existing data governance tools to automate the mapping of their systems and APIs to the MISMO standards.

“We’re constantly given additional APIs to build, but we’re not given additional technical staff to help with these efforts. Database Core will help us build more integrations with fewer resources.” – Manager of a major Loan Origination System (LOS)

Leverage existing data governance tools to map to the MISMO standards

Streamline the creation of MISMO API datasets

Reduce the need for an internal comprehensive understanding of the MISMO schema models

Professional Services

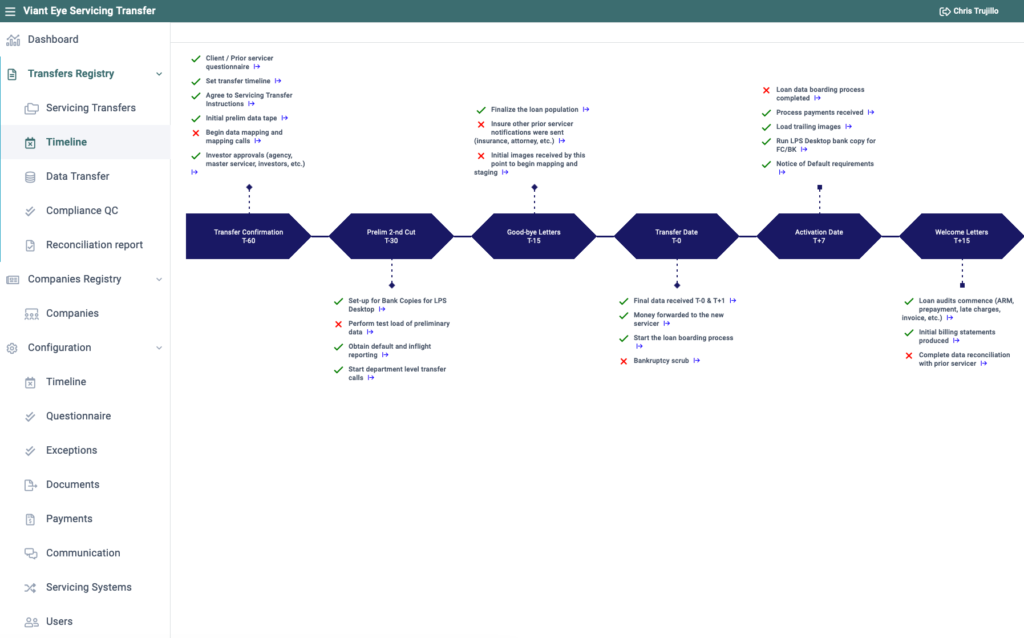

Viant Eye provides professional services in the mortgage industry, utilizing extensive expertise and innovative solutions to streamline compliance, data validation, eVault transactions, servicing transfers, and regulatory monitoring. With a strong foundation in MISMO standards, our services are designed to address the evolving needs of the mortgage industry, enhancing efficiency and reducing errors while ensuring compliance with industry requirements.